Overview

The checker accepts the following parameters:bvn— Bank Verification Number

BVN Input Validation

Thebvn (Bank Verification Number) should be a valid 11-digit number. This number is used for identity verification and must match the following pattern:

- Pattern: 11 digits (

\d{11})

Getting started

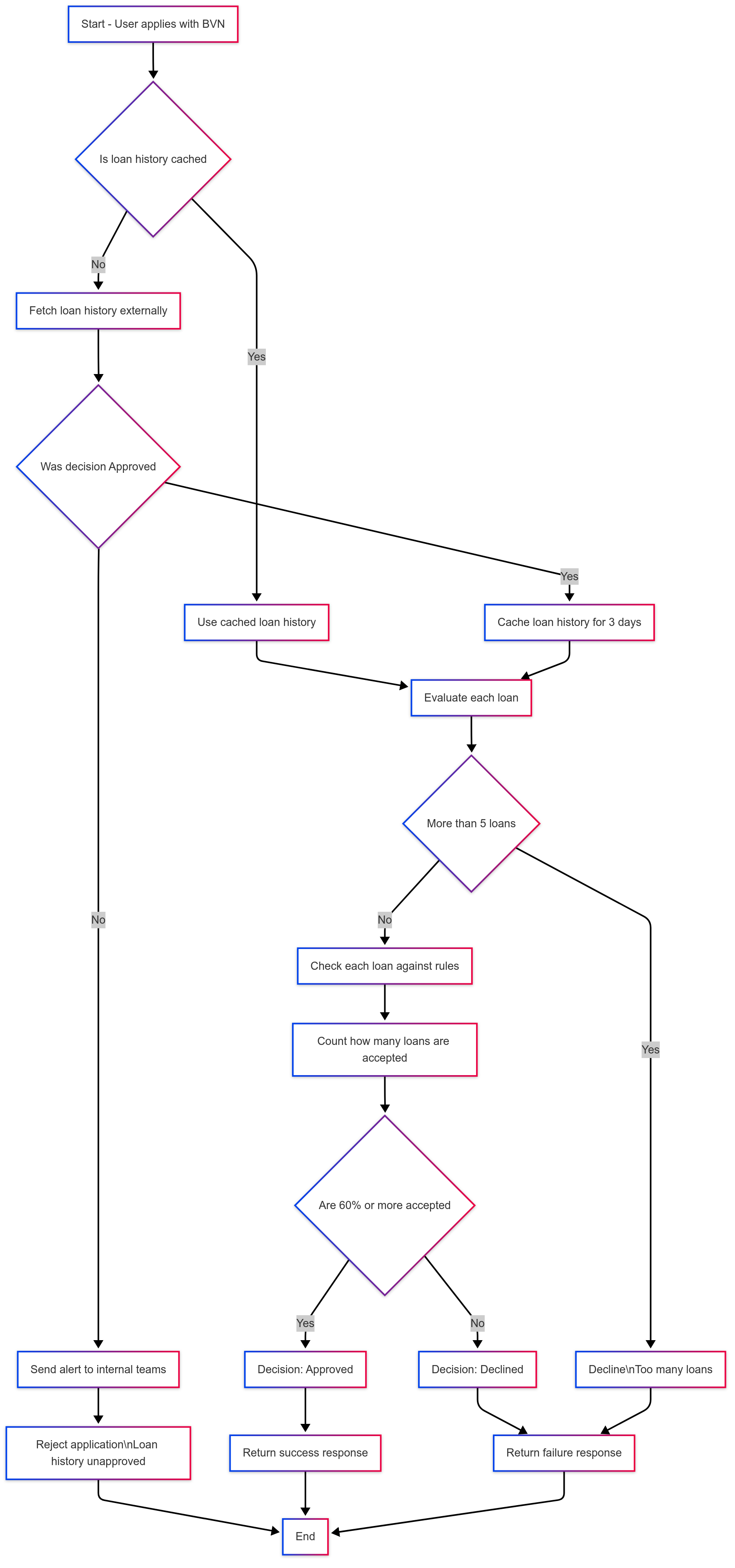

To get started, you can use the Credit History Check endpoint.Loan Evaluation – Overview

This system helps determine whether a user’s loan application should be approved or declined based on their financial history. It uses two main processes:

It uses two main processes:

- Loan History Retrieval

- Loan History Evaluation

Step 1: Loan History Retrieval

Before evaluating an application, the system first tries to fetch the user’s loan history using their BVN (Bank Verification Number).Here’s how it works:

- It checks if loan history is already stored in the system (cached).

- If found, it uses that data immediately to speed things up.

- If not found, it retrieves the loan history from an external service.

- If the history indicates issues, it sends an alert to the relevant teams and stops the process.

- If the history is acceptable, it saves it in the system for future use (for up to 3 days).

Step 2: Loan History Evaluation

Once the system has the loan history, it evaluates each loan record to decide if the application should be approved.Here’s what the system looks for:

- No loan history at all → The application is automatically approved.

- Too many existing loans (more than 5) → The application is declined.

- Individual loan checks:

- Performing loans with no arrears → ✅ Accepted

- Minor arrears (1–30 days), marked as “pass and watch” → ✅ Accepted

- Substandard loans with minor overdue amounts → ✅ Accepted

- Doubtful loans with moderate arrears → ✅ Accepted

- Lost loans with over 90 days in arrears → ❌ Rejected

- Anything else → ✅ Accepted by default

Final Decision

After reviewing all loans:- If 60% or more of the loans are acceptable → The application is approved.

- If less than 60% are acceptable → The application is declined.

Quick Summary

- Retrieve the user’s loan history using their BVN.

- Evaluate each loan based on a set of rules.

- Decide:

- If most loans are okay → The user is approved.

- If many loans are problematic → The user is declined.

- Notify relevant teams if there’s a rejection.

- Cache the result for next time.